Tariff Deflation Thesis: 150-Year Federal Reserve Study…

Tariff Deflation Thesis: 150-Year Federal Reserve Study Shows 4pp Tariff Increases Lower Inflation 2pp, Raise Unemployment 1pp Through Demand Shocks

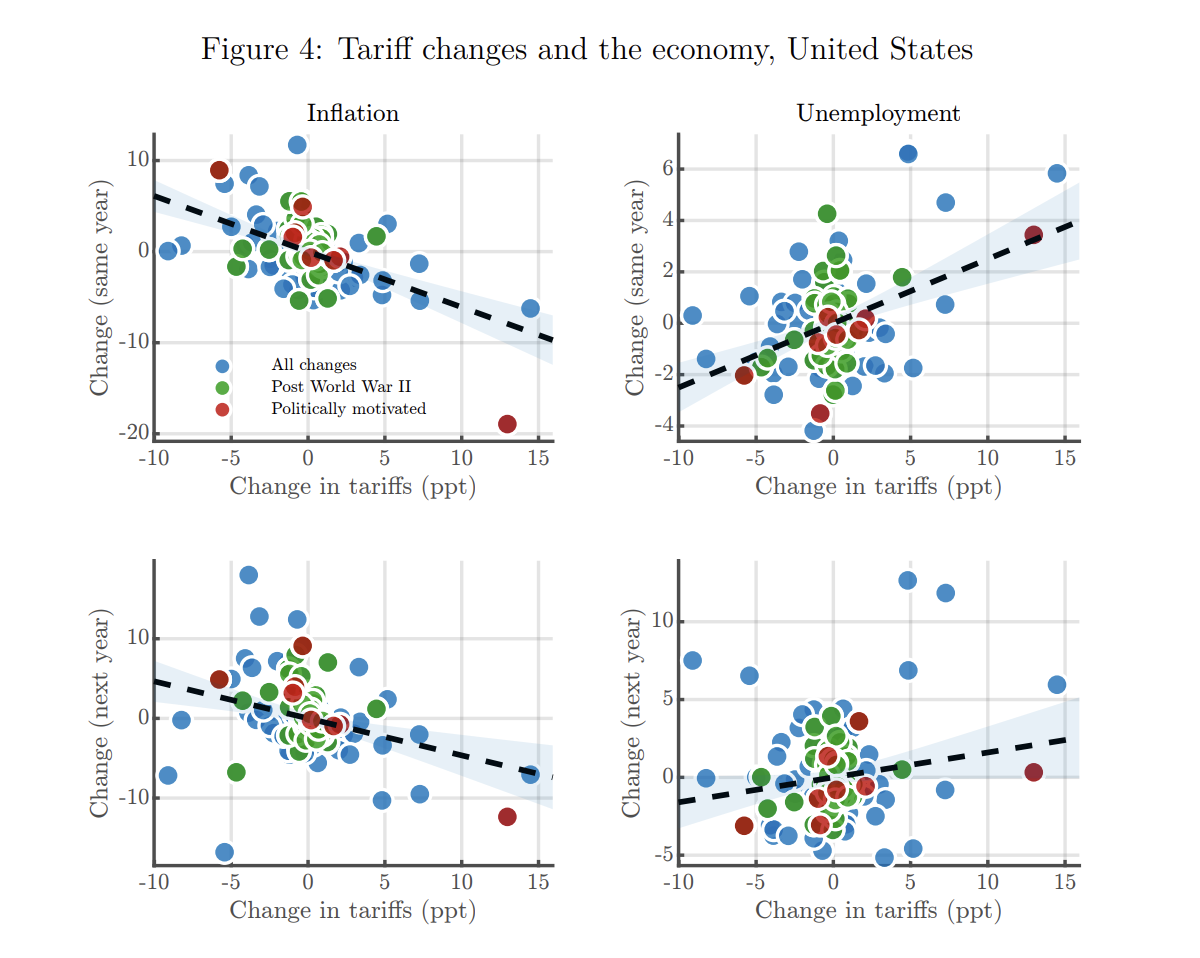

Federal Reserve Bank of San Francisco's 150-year historical analysis across US, UK, and France reveals tariffs operate as adverse aggregate demand shocks rather than cost-push inflation drivers, where 4-percentage-point permanent tariff rate increases lowered inflation 2 percentage points while raising unemployment 1 percentage point, contradicting conventional wisdom through uncertainty and wealth channels depressing consumer spending and asset prices, with 2018-2019 US-China trade conflict demonstrating 1-year lag deflationary crashes.

Source: FEDERAL RESERVE BANK OF SAN FRANCISCO

Conventional Wisdom Challenged: 150-Year Empirical Evidence

Contemporary economic discourse assumes tariffs are inherently inflationary through straightforward logic: taxing foreign goods raises import costs passing through to consumers as higher prices. However, groundbreaking Federal Reserve Bank of San Francisco working paper provides empirical evidence fundamentally challenging this conventional wisdom.

Historical Data Scope: Drawing on 150 years of tariff policy data from United States, France, and United Kingdom, researchers Régis Barnichon and Aayush Singh conclude that historically, tariff hikes are often deflationary events that lower CPI inflation and raise unemployment.

Quasi-Random Policy Changes: To identify causal tariff effects, economists must separate tariff changes from underlying economic states. Authors conducted narrative reviews of US policy since 1870 and found tariff changes were often "quasi-random" regarding business cycles.

Ideological Flip-Flops: Historically, Republicans and Democrats held diametrically opposed protectionism views. During late 19th century high-unemployment periods, Democrats favored lowering tariffs assisting consumers, while Republicans favored raising them protecting northern industries. Because political power flipped frequently, tariff change directions were often dictated by ideological preference rather than economic necessity—this historical "noise" allows observing tariff impacts across various economic conditions.

Aggregate Demand Shock Pattern

Sources reveal consistent patterns: regardless of time period (pre- or post-WWII) or country (US, UK, France), tariff hikes lead to economic activity contractions and inflation declines.

Pre-WWII US Data: In pre-WWII US samples, 4-percentage-point permanent tariff rate increases lowered inflation 2 percentage points and raised unemployment approximately 1 percentage point—substantial macroeconomic impacts.

Demand Shock Not Cost-Push: This finding suggests tariffs don't behave like "cost-push" shocks—which typically raise prices while lowering output—but rather like adverse aggregate demand shocks reducing both output and prices simultaneously.

Modern Confirmation: While tariff volatility decreased significantly post-WWII, researchers found modern data still points in same direction: higher tariffs correlate with lower inflation and higher unemployment, confirming historical patterns persist despite changed global trade architecture.

European Evidence: Independent data from first globalization wave in France and UK confirms these results. In both European cases, tariff hikes were followed by declining inflation and contracting GDP growth—cross-country validation strengthening causal inference.

Deflationary Transmission Channels

Researchers identify two primary channels through which tariffs depress aggregate demand and consequently prices, contradicting simple cost-pass-through narratives.

Uncertainty Channel: Tariff shocks create or coincide with uncertain economic environments. This uncertainty erodes consumer and investor confidence, causing spending pullbacks that put downward pressure on inflation through reduced demand rather than increased costs.

Wealth Channel: High tariffs strongly correlate with declining asset prices. Data shows tariff increases lead to lower stock market valuations and increased market volatility. This reduction in household and corporate wealth further suppresses demand and lowers price levels through negative wealth effects.

Combined Impact: These channels work synergistically: uncertainty reduces investment and consumption plans while simultaneously depressing asset values, creating feedback loops where declining wealth reinforces cautious behavior, magnifying deflationary pressures beyond initial direct trade effects.

2018-2019 Case Study: 1-Year Lag Effect

Historical patterns suggest tariffs might not immediately lower prices but trigger deflationary "crashes" after certain periods, demonstrated by recent US-China trade conflict.

2018 Resilience: During 2018 US-China trade conflict, many expected immediate inflation, but economy remained strong that year despite substantial tariff impositions—confounding conventional predictions.

2019 Crash: By 2019, economy began struggling significantly, described as "1-year lag effect" of tariff-induced deflation where delayed aggregate demand impacts finally materialized in economic performance deterioration.

Pattern Confirmation: This recent experience confirms historical patterns where tariff economic impacts operate with substantial lags, making real-time policy assessment difficult and creating temptation to prematurely conclude tariffs are inflationary before deflationary effects fully manifest.

Logical Unemployment Contradiction

The tariff inflation theory faces logical inconsistency when confronting simultaneous unemployment increases documented across 150-year dataset.

Rising Unemployment Evidence: Data consistently shows tariffs lead to higher unemployment rates across countries and time periods—robust empirical regularity requiring theoretical explanation.

Logical Inconsistency: It is logically contradictory to argue prices will continue rising (inflation) while economies worsen and more people lose jobs—standard economics suggests weak demand from unemployment should depress rather than elevate prices.

Demand Destruction: Unemployment represents demand destruction through reduced income and spending capacity—this should logically produce deflationary rather than inflationary pressures, yet conventional tariff wisdom ignores this fundamental contradiction.

China Dumping Strategy: Deflationary Amplification

China's response to global tariff pressure often involves ramping manufacturing to maintain industrial dominance, creating additional deflationary forces beyond direct tariff effects.

Export Flooding: To weaken manufacturing sectors of potential adversaries, China exports high-quality goods (like EVs) at extremely low prices—deliberate industrial strategy leveraging manufacturing overcapacity.

Global Deflationary Pressure: This massive influx of cheap goods creates significant global deflationary pressure, counteracting expected price hikes from tariffs through competitive supply responses overwhelming demand-side cost increases.

Strategic Pricing: China's willingness to accept temporarily unprofitable pricing to maintain market share and industrial capacity utilization means tariff cost increases get absorbed by Chinese producers through margin compression rather than passed to consumers through higher prices.

Monetary Policy Implications

For economists and financial professionals, these findings suggest inflationary tariff impacts may be overestimated in standard models, requiring fundamentally different policy responses.

Optimal Response Recalibration: If tariffs primarily act as drags on aggregate demand by triggering uncertainty and depressing asset prices, "optimal" monetary policy responses may not be tightening interest rates fighting inflation, but rather managing resulting economic slowdowns and potential deflationary pressures.

Policy Mistake Risk: Central banks fighting non-existent tariff inflation through rate hikes risk compounding deflationary aggregate demand shocks with restrictive monetary policy, creating unnecessarily severe economic contractions.

Forecasting Accuracy: Understanding these general equilibrium effects is crucial for accurately forecasting macroeconomic trajectories of protectionist policies as global trade landscapes continue shifting.

Asset Allocation Under Deflationary Regime

Given strong arguments for impending deflationary pressure, personal investment strategy adjustments require nuanced understanding beyond simple "sell everything" reactions.

Liquidity Misconception: The idea that central banks pumping money is sole driver of stock, housing, and crypto prices is largely political argument, not factual—Fed's balance sheet actually shrunk in recent years, yet key asset prices continued rising.

Concentrated Market Strength: Today's market strength is highly concentrated, not broad-based. In real estate, not entire markets boom, but only most desirable high-demand residential areas like prime New York, California, Texas or Asian metropolitan zones; commercial real estate and peripheral areas often struggle or are "dead."

Stock Market Bifurcation: Similarly, in stock markets, most growth is carried by small numbers of dominant tech companies, with majority of other stocks lagging far behind—winner-take-most dynamics rather than broad market rallies.

Gold: Geopolitical Not Inflation Hedge

Many view gold as ultimate inflation hedge, but data suggests much stronger correlation with different factor: US military spending as geopolitical risk hedge.

Defense Spending Correlation: As major powers increase defense budgets—US planning boosting defense spending significantly, perhaps nearing $1.5 trillion—investors flock to gold as safety mechanism against global instability and potential conflict.

Deflation Resilience: Therefore, even if deflation reigns supreme, intensifying global tensions and ongoing strategic US-China competition will likely sustain high demand for assets tied to security and concentrated value.

Strategic Opportunity: Market shocks such as negative tariff court rulings should be viewed as buying opportunities; creative human intervention will quickly find workarounds, and underlying strategic trajectory—China pressure—remains unchanged regardless of short-term legal or economic disruptions.

Investment Strategy Synthesis

Quality Concentration: Focus on highest-quality concentrated assets in prime locations and dominant market position companies rather than broad market exposure given bifurcated performance patterns under deflationary pressures.

Geopolitical Hedge Maintenance: Maintain gold allocation as geopolitical risk hedge tied to defense spending increases and strategic competition intensification regardless of inflation trajectory contradicting traditional inflation-hedge framing.

Deflation Beneficiaries: Position for deflationary forces through quality credit instruments, cash positions, and assets benefiting from lower input costs rather than inflation-protection strategies contradicting 150-year historical tariff evidence.

Lag Awareness: Recognize 1-year lag effects in tariff economic impacts—initial economic resilience shouldn't be interpreted as permanent, as deflationary crashes typically materialize with substantial delays requiring patient positioning.

Shock Opportunities: View market shocks from tariff policies or legal rulings as buying opportunities rather than existential threats, recognizing that strategic imperatives (China containment) override short-term disruptions and human creativity finds policy workarounds.

The Federal Reserve's 150-year historical analysis fundamentally challenges conventional tariff inflation wisdom, demonstrating 4-percentage-point tariff increases lower inflation 2 percentage points while raising unemployment 1 percentage point through adverse aggregate demand shocks operating via uncertainty and wealth channels rather than cost-push mechanisms, with 2018-2019 US-China trade conflict confirming 1-year lag deflationary crashes and China's dumping strategy amplifying deflationary pressures, requiring investment strategies emphasizing concentrated quality assets, geopolitical hedges like gold correlated with defense spending rather than inflation, and viewing tariff-related market shocks as buying opportunities given underlying strategic China containment imperatives remaining unchanged despite short-term economic disruptions.